Indus Valley Annual Report 2023 by Blume Ventures

scroll to the bottom for a couple of funny memes

Blume Ventures - one of the most successful venture firms in the country (Slice, unacademy, Dunzo, Grey Orange, purplle) - has released the second edition of its annual report on the Indian startup ecosystem. Blume has dubbed the scattered but vibrant scene - the ‘Indus Valley.’ It does not carry overt geographical connotations because successful startups are increasingly found outside the BLR, NCR, Andheri-Powai belt.

The first edition can be found, quite amateurishly, if I may add, on this official drive link.

The latest can be found here.

Find screenshots, one-liners (from the deck), and personal commentary (in block quotes) below:

Highlights

Interpreting India - or as MICAns would like to call it Imagining India

India under-invests in Gross Fixed Capital Formation (growth chokepoint); individual consumption disproportionately drives GDP,

Super-sized services sector, >50% of GDP,

software exports has grown to ~26% of overall exports in 2021-22, versus 13.5% in 2004-05,

80% of IT-BPM sector in India is exports,

30% of all white collar jobs

Macro Indicators

We form a minority of the Indian internet

What this means is - a smaller-than-expected market - for ads, cards, cars, or anything really. A truth foreign venture capitals have bumped against time and again. The billion users promise is a lie. See the consumer stack below. Great visualisation

Factors driving India’s manufacturing

Government Incentives

India’s Low Labour Costs

Imminent Capex Recovery Cycle

Indian growth model - WEAGan model - ‘Weak’ East Asian Growth

Strong manufacturing exports & growth

Transport & trading friction reduction across India

Welfarism

Supersized services sector

Vibrant startup sector

Challenges to growth

a sharp drop in consumption outside the top 30 million HHs (truncated TAM)

tapering in frequent user base

rational optimism at best, about tapping Indian consumer base. see bone chilling charts below

e-commerce penetration set to plateau, where do we go next? Rural HHs —> Low ARPUs. Top-of-funnel is slowing as the impact of UPI-Demonetisation + Jio + COVID-led digital adoption is slowing. Party time is over.

VC in India as of date

India punches above its economic class in VC funding (3.4% of global GDP share, vs 4.8% VC funding share) versus China (18% of global GDP share vs 13.6% VC funding share)

Indian startup playbook set to become standard in other Asian emerging markets, as a Bangladesh has more in common with India than a USA

VC = disproportionate share of Indian capital market (exceed Mutual Funds inflow unlike US market)

Fintech

Growth led by unsecured, small-ticket loans from new-to-credit consumers,

Fintech cos don’t enjoy the high involvement that traditional banks enjoy, but frequent use increases opportunities to cross-sell,

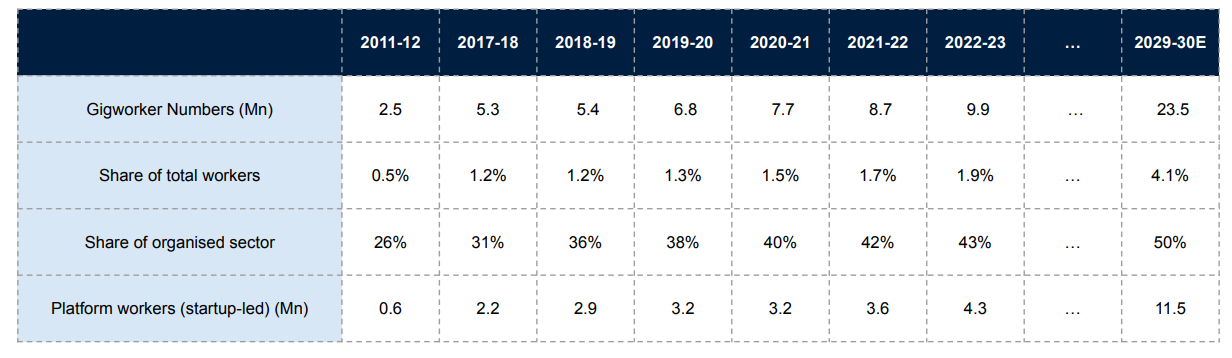

Manufacturing & Labor

parallel manufacturing that leverages MSME manufacturers has given rise to ‘cloud factories’ and increased use of technology,

startups have also organized labor pool - 10% of all white collar jobs are in startups

gig work model also emerged from startups,

read my super-short summary of the NITI Aayog’s Gig Economy Report here

Money Talk

growth funding cools down

average seed round size has increased by 3x in the last 5 years

capital supply,

rise of pedigreed founders

2nd time founders,

top executives spinning out

Blume is also an early-stage investor

unicorn minting slows down (44 in 2021, 23 in 2022 H1, 0 in 2022 H2)

ESOP buybacks drops to half,

listing rates go down

retail investors missing out

What can startups learn from traditional cos

I am skipping the sector-wise analysis - Clean Tech (green energy, EVs), Media, e-commerce, SaaS as they are short and packed full of information. Page 90 onwards of the full-length report.

Indus Valley Playbook

I would especially recommend slides 116 onwards - broad stroke analysis of “types” of companies, what they do differently, who they target, and ending with 5 distinct India-unique models.

Bye! Here are the memes.